Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When it comes to online banking, there are a lot of options out there. But which one is the best? The answer may vary depending on who you ask, but there are a few banks that consistently rank at the top of the list. If you’re looking for the best online banks, you can’t go wrong with any of the following.

Here are the best online banks:

About:

Ally Bank is one of the most popular & the Best online banks. It offers a great interest rate on savings accounts and has no monthly fees.

Ally Bank is one of the largest online banks in the United States. As of 2016, Ally Bank had $148 billion in assets and over 1.6 million customers. Ally Bank offers a variety of personal banking, business banking, and lending products and services.

Ally Bank is a Member of FDIC and an Equal Housing Lender. Ally Bank is headquartered in Sandy, UT, and has branches in Colorado, Florida, Illinois, Indiana, Michigan, Ohio, and Texas.

Ally Bank offers a variety of personal banking products and services including savings accounts, checking accounts, money market accounts, certificates of deposit (CDs), and IRA accounts. Ally Bank also offers a variety of lending products including auto loans, home loans, and personal loans.

Ally Bank offers a variety of business banking products and services including business checking accounts, business savings accounts, business money market accounts, business lending products, and merchant services.

Ally Bank has a variety of online and mobile banking products and services. Customers can access their accounts online or through the Ally mobile app. Ally Bank also offers 24/7 customer service support.

Overall, Ally Bank is a large online bank that offers a variety of personal banking, business banking, and lending products and services. Ally Bank is an FDIC member and an Equal Housing Lender. Ally Bank is headquartered in Sandy, UT.

There are a lot of reasons why people choose the bank they do. Some people go with a bank because it’s convenient – it has a location near their home or workplace. Others choose a bank because it offers a certain type of account or financial product they’re looking for. And still, others simply choose a bank because it has a good reputation.

We chose Ally Bank for all of those reasons.

Convenience: Ally Bank has both online and mobile banking options, so it’s easy to do your banking when and where it’s convenient for you.

Accounts and products: Ally Bank offers a full range of banking products including checking and savings accounts, credit cards, and loans.

Reputation: Ally Bank is one of the largest online banks and has a history of happy customers.

When you’re looking for a new bank, it’s important to consider all of your options. We’re confident that you’ll find Ally Bank to be a great choice for your banking needs.

Choosing the best online bank for your needs can be overwhelming. There are so many options available and it can be hard to decide which one is right for you. To help make the decision easier, we’ve put together a list of the pros and cons of Ally Bank.

Ally Bank is one of the largest online banks and has been in operation for over a decade. They offer a wide range of products and services, including savings and checking accounts, credit cards, loans, and investment products. Ally Bank is FDIC-insured and offers 24/7 customer support.

Ally Bank is a great option for those who are looking for an online bank. They offer a wide range of products and services and have 24/7 customer support. If you don’t mind doing your banking online, Ally Bank is a great choice.

About:

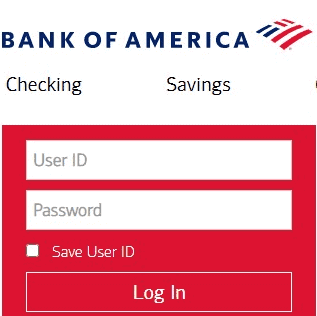

Bank of America is one of the oldest and largest commercial banks in the United States. With over 5,000 branches and 16,000 ATMs across the country, it’s easy to find a Bank of America location near you. The bank also has a strong online presence, with a website that is easy to navigate and mobile and online banking that is simple to use.

Here’s why we picked Bank of America for the best online banking experience:

Convenience: Bank of America’s online banking platform is extremely convenient. You can easily check your account balance, transfer money, pay bills, and more.

Security: When it comes to online banking, security is always a top concern. Bank of America takes security seriously, with multiple layers of protection to keep your information safe.

Mobile app: Bank of America’s mobile app makes it easy to bank on the go. You can check your account balance, transfer money, pay bills, and more, all from your mobile device.

Rewards: With Bank of America’s online banking platform, you can take advantage of the bank’s rewards program. With points that can be redeemed for cash back, travel, and more, you can make the most of your money with Bank of America.

Customer service: If you ever have any questions or issues with your account, Bank of America’s customer service team is always there to help.

These are just a few of the reasons why we picked Bank of America for the best online banking experience. If you’re looking for a safe, convenient, and user-friendly online banking platform, Bank of America is the clear winner.

Overall, we believe that Bank of America is a great option for online banking. It offers a wide range of products and services, has a user-friendly website and mobile app, and is a well-trusted and established bank.

About:

Capital One is an American bank holding company headquartered in McLean, Virginia. Capital One is ranked 10th on the list of largest banks in the United States by assets. It is a diversified bank, with operations in consumer banking, commercial banking, credit cards, auto loans, banking, and financing.

Capital One is a great option for online banking. They offer a variety of account types and have a user-friendly website. You can also get help from their customer service team 24/7.

Capital One is a leading financial services company that offers a wide range of products and services to its customers. Capital One has a strong presence in the United States and is one of the largest banks in the world. The company has a wide variety of products and services including credit cards, loans, and investment products. Capital One also offers a wide range of banking services such as online banking, mobile banking, and phone banking.

Here’s why we picked Capital One 360 as the best online bank:

1. No fees. That’s right – no fees. No monthly maintenance fees, no minimum balance fees…nothing.

2. Free checking and savings. With Capital One 360, you get a free 360 Performance Savings account with no minimum balance and no monthly fees, as well as a free 360 Checking account.

3. Higher Interest Rates. Capital One 360 offers some of the highest interest rates we’ve seen from an online bank. For example, their 360 Savings account currently offers a 0.75% Annual Percentage Yield (APY).

4. Easy-to-use mobile app. Capital One 360’s mobile app is one of the most user-friendly we’ve come across. It’s streamlined and simple to use, making it easy to check your balance, make transfers, and more.

5. 24/7 customer service. Whether you have a question about your account or need help with something, Capital One 360’s customer service team is available 24/7 to help.

There you have it – our top 5 reasons why Capital One 360 is one of the best online banks. If you’re looking for an online bank that offers great interest rates, free checking and savings, and excellent customer service, look no further than Capital One 360.

Now that you know a little bit more about Capital One, you can make an informed decision about whether or not it is the right bank for you.

About:

Chase Bank is one of the oldest and most trusted banks in the United States. With a history dating back to 1799, Chase has a long tradition of providing quality banking services to its customers. Today, Chase is one of the largest banks in the country, with more than 5,000 branches and 16,000 ATMs nationwide.

Chase Bank offers a full range of banking services, including checking and savings accounts, credit cards, loans, and investment products. Chase also has a strong online presence, with a website that is easy to use and navigate. Customers can use the website to check their account balances, transfer money, pay bills, and more.

Chase Bank is a great choice for customers who are looking for a reliable and well-established bank. With a wide range of products and services, Chase is a good choice for customers who want a one-stop shop for all their banking needs.

We researched for you and we’ve narrowed it down to Chase Bank. Here’s why we think Chase is one of the best online banks for you:

1. Chase offers a great selection of products and services. From checking and savings accounts to credit cards and loans, they have everything you need.

2. Chase has a long history of providing excellent customer service. They have 24/7 customer support available by phone, email, or live chat.

3. Chase has a user-friendly website and mobile app. Their online and mobile banking platforms are easy to use and offer all the features you need.

4. Chase is a large, well-established bank. They have over 5,000 branches and 16,000 ATMs across the country.

5. Chase offers competitive interest rates on its products. Whether you’re looking for a savings account or a loan, you’ll get a great rate with Chase.

There you have it! These are just a few of the reasons why we think Chase Bank is the best online bank for you. Head over to their website and see for yourself.

As one of the largest banks in the United States, Chase offers a full range of banking products and services including checking and savings accounts, credit cards, mortgages, auto loans, investment products, and small business banking. In addition to its vast array of products and services, Chase also has a strong online and mobile banking platform with robust features and functionality. Customers can easily manage their accounts, transfer money, pay bills, and more. In addition, Chase offers excellent customer service with 24/7 live support.

Now that we’ve given you an overview of Chase Bank, let’s take a look at the pros and cons.

Now that we’ve taken a look at the pros and cons of Chase Bank, it’s up to you to decide if it’s the right bank for you.

About:

Discover Bank has been in business for over 30 years and offers a full range of banking products, including Checking, Savings, Money Market, and Certificate of Deposit accounts. They also offer a full suite of loan products, including Mortgages, Home Equity Loans, Auto Loans, and Personal Loans. Discover Bank is a member of the FDIC and is an online-only bank, which means they have no brick-and-mortar branches.

We’ve done the research for you and discovered that Discover Bank is one of the best online banks out there. They offer great rates on savings and checking accounts, and they don’t charge any hidden fees. Plus, their customer service is top-notch.

Here’s why we picked Discover Bank as one of the best online banks:

Savings Accounts

Discover Bank offers some of the best interest rates on their savings products. This is important because it allows you to grow your money faster. They offer a 0.75% APY on their online savings account and a 1.50% APY on their money market account. This is significantly higher than the average interest rate of 0.05% APY for savings accounts and 0.60% APY for money market accounts.

Fees

One of the biggest advantages of Discover Bank is that they have very few fees. They don’t have any fees for their savings or money market accounts. This is a big contrast to other online banks which often charge fees for things like monthly maintenance, ACH transfers, and international transfers.

Mobile App

Discover Bank has a great mobile app that makes it easy to bank on the go. The app is available for both iPhone and Android devices. It allows you to do things like check your account balance, transfer money, and deposit checks. The app is very user-friendly and makes it easy to bank on the go.

These are just a few of the reasons why we picked Discover Bank for the best online banking. They offer great interest rates, have very few fees, and have a great mobile app. If you’re looking for an online bank, we think Discover Bank is a great option.

Overall, we believe Discover Bank is a great choice for anyone looking for an online bank. They offer a wide range of products and services, have a strong reputation, and are FDIC-insured.

About:

USAA was founded in 1922 by a group of military officers who saw the need for a financial services company that understood the unique challenges of military life. USAA has grown to serve over 12 million members and is proud to be a leading provider of insurance, banking, and investing services to the military community.

USAA is a financially strong company, with over $26 billion in assets and a member-owned insurance program. USAA is consistently recognized for its outstanding customer service and was named the “#1 Military Friendly Company” by G.I. Jobs magazine for the ninth consecutive year.

As a company that has always been there for its members, USAA is committed to being there for the military community in the future. USAA will continue to provide the products and services that military families need, and will always be there to help in times of need.

There are many reasons why we picked USAA for Best Online Bank. Here are some of the key reasons:

They offer a great user experience: USAA’s website is easy to use and navigate, and their mobile app is top-notch. They offer all the features we look for in a great online bank, including online bill pay, mobile deposits, and remote check deposits.

They have low fees: USAA doesn’t charge any monthly fees, and their ATM withdrawal fees are very reasonable.

They have great customer service: USAA’s customer service is excellent. They offer live chat, phone support, and even 24/7 support for their members.

They are a great choice for military members and their families: USAA is a great choice for military members and their families. They offer a wide range of banking and financial services, and they have a long history of serving the military community.

When it comes to choosing a financial institution, there are a lot of options out there. However not all options are created equal. USAA is a unique financial institution that offers a variety of services and benefits, but it also has a few drawbacks. Here are the pros and cons of USAA.

Overall, USAA is a great option for those who are eligible to join. It offers a wide range of services and has a reputation for excellent customer service. However, it does have some drawbacks, such as strict eligibility requirements and a limited number of physical locations.

About:

SoFi is a personal finance company that offers student loan refinancing, private student loans, and mortgage loans. The company was founded in 2011 by four students at Stanford University to help their peers pay off their student loans. To date, SoFi has helped over 500,000 people save money on their loans and achieve their financial goals.

SoFi offers several features that make it a great choice for borrowers. First, there are no origination fees or prepayment penalties. Second, SoFi has a generous referral program that gives borrowers $100 for every person they refer who takes out a loan with the company. Third, SoFi offers a variety of repayment options, including fixed-rate, variable-rate, and interest-only repayment plans.

If you’re looking for a personal finance company that can help you save money on your loans and achieve your financial goals, SoFi is a great choice.

We picked SoFi is one of the best online banks because it has great rates, low fees, and superior customer service. We also like that it provides access to personal financial planning tools and resources.

SoFi has some of the best interest rates and lowest fees of any online bank. For example, its checking and savings accounts offer 0.25% and 0.50% APYs, respectively. And there are no minimums to open an account or earn interest.

SoFi also has excellent customer service. Representatives are available 24/7 to help with anything from account setup to loan refinancing. And if you’re ever unhappy with a SoFi product, you can get your money back within 30 days with its happiness guarantee.

SoFi also provides access to helpful personal finance resources, such as a student loan refinancing calculator and budgeting tools. These can be helpful if you’re trying to get a handle on your finances or save money on your monthly expenses.

Overall, we think SoFi is a great option for anyone looking for an online bank with great rates, low fees, and superior customer service.

When it comes to financial products, there are a lot of things to consider before making a decision. SoFi is a popular financial product, but it’s not right for everyone. Here are some pros and cons of SoFi to help you decide if it’s right for you.

About:

CIT Bank is a large regional bank headquartered in Pasadena, California. The bank has over 80 branches in California, Oregon, and Washington. CIT Bank offers a full range of banking services, including checking and savings accounts, loans, and credit cards.

CIT Bank has a long history dating back to the early 20th century. The bank was founded in Pasadena in 1908 as the Commercial Investment Trust. The trust was created to provide financing for the development of commercial real estate in Southern California.

In the early years, the trust grew rapidly, financing the construction of office buildings, hotels, and other commercial properties. During the Great Depression, the trust helped to stabilize the local economy by continuing to lend money for commercial development.

In the 1970s, the trust expanded beyond Southern California and changed its name to CIT Financial. The bank continued to grow and acquired several other banks in the 1980s. In the 1990s, CIT Financial changed its name to CIT Bank to reflect its expanding range of services.

Today, CIT Bank is a strong and stable institution with a strong commitment to the communities it serves. The bank continues to invest in the growth of the region, financing the construction of new homes, businesses, and infrastructure. CIT Bank is a great choice for those looking for a full-service bank with a long history of success.

Here are a few reasons why we picked CIT Bank as the best online bank:

1. CIT Bank has great interest rates

If you’re looking to earn interest on your savings, CIT Bank is a great option. They offer some of the best interest rates on both savings accounts and CDs.

2. CIT Bank is FDIC insured

When you bank with CIT Bank, you can rest assured that your deposits are FDIC-insured. This means that your money is protected if the bank fails.

3. CIT Bank offers a great mobile app

If you like to bank on the go, you’ll love the CIT Bank mobile app. It’s user-friendly and makes it easy to manage your account from your phone.

4. CIT Bank has 24/7 customer support

If you ever have any questions or problems with your account, CIT Bank has 24/7 customer support. This means that you can always get help when you need it.

5. CIT Bank is a great choice for online banking.

If you’re looking for an online bank that offers great interest rates, mobile banking, and customer support, CIT Bank is a great choice.

As a CIT Bank customer, you’ll have access to one of the best online banks. You can expect great customer service, a user-friendly website, and top-notch security. CIT Bank also offers some of the best rates available for online savings accounts.

When it comes to online banks, CIT Bank is a great choice. But like all banks, there are some pros and cons to consider.

When it comes to online banks, CIT Bank is a great choice. But like all banks, there are some pros and cons to consider. Overall, CIT Bank is a great option for customers who want great rates, top-notch security, and excellent customer service.

About:

As one of the newest online-only banks, Vio Bank has quickly become a popular choice for people who are looking for an alternative to the traditional banking system. Vio Bank offers several advantages over traditional banks, including a higher interest rate on savings accounts, no fees for checking or savings accounts, and a mobile app that makes it easy to manage your money on the go.

One of the things that set Vio Bank apart from other online-only banks is that they are a division of MidFirst Bank. MidFirst Bank is a large, well-established bank that has been serving customers for over 100 years. This means that Vio Bank has the backing of a large financial institution, which gives them the stability and resources to offer great rates and service to their customers.

Vio Bank offers several different account options, including personal checking and savings accounts, as well as business banking products. They also have several different loan products, including personal loans, home equity loans, and auto loans.

If you’re looking for an online bank that offers great rates, no fees, and a mobile app, Vio Bank is a great option.

Vio Bank is one of the few online-only banks available in the US. While THE USAA and Ally offer similar services, Vio Bank is our choice for the best online bank. Here are a few reasons why:

1. They offer a competitive interest rate on savings accounts (1.35% APY).

2. There are no fees for account maintenance, no minimum balance requirements, and no monthly service charges.

3. They provide customer service 24/7 via live chat, email, and phone.

4. They have a mobile app that allows you to deposit checks and track your spending.

5. They offer a wide variety of products, including savings accounts, CDs, IRAs, and money market accounts. While Vio Bank doesn’t have brick-and-mortar locations, they more than makeup for it in terms of customer service and features.

If you’re looking for an online-only bank, we highly recommend Vio Bank.

Here are some pros and cons to consider when deciding if Vio Bank is the right online bank for you:

To sum up, Vio Bank is a new, online-only bank that offers a high-yield savings account with a competitive interest rate. They have no hidden fees and offer 24/7 customer service. However, they are only available to residents of the United States and only offer savings accounts and CDs at this time.

About:

Quontic Bank has been in operation for over 10 years and is headquartered in New York City. The bank offers a variety of services including personal and business banking, commercial lending, and home mortgages. Quontic has a team of experienced bankers that can provide personalized attention to each customer.

In terms of personal banking, Quontic offers checking and savings accounts with competitive interest rates. Customers can also take advantage of the bank’s online banking platform which offers 24/7 access to account information and transactions. For businesses, Quontic provides a suite of services including business checking and savings accounts, merchant services, and business loans. Quontic’s commercial lending team can also assist businesses with project financing.

In addition to traditional banking services, Quontic also offers several unique products such as its “QCard” which is a reloadable prepaid debit card. The QCard can be used anywhere Visa is accepted and can be used to withdraw cash from ATMs. Quontic also offers home mortgages and home equity lines of credit.

Whether you are looking for personal or business banking services, Quontic Bank has a solution for you. With its experienced team of bankers and array of unique products, Quontic is a great choice for your Online banking needs.

There are a lot of banks to choose from, but we think Quontic Bank is the best online bank. Here’s why:

1. Convenient: Quontic Bank’s online and mobile banking services are convenient and easy to use. You can check your balance, transfer money, pay bills, and more.

2. Friendly and helpful customer service: Quontic Bank’s customer service is friendly and helpful. They’re always willing to help with any questions you may have.

3. Great interest rates: Quontic Bank offers great interest rates on their savings accounts and CDs. This is a great way to grow your money.

4. No monthly fees: Quontic Bank doesn’t charge any monthly fees. This is a great way to save money.

5. Give back to the community: Quontic Bank is committed to giving back to the community. They offer free financial education workshops and support local charities.

We think Quontic Bank is the best online bank because they offer convenient online and mobile banking services, great interest rates, and they give back to the community. If you’re looking for a new online bank, we recommend Quontic Bank.

1. High Interest Rates

Quontic Bank offers some of the highest interest rates on savings and checking accounts. For example, its online savings account offers an impressive interest rate of 0.60% APY. This is far higher than the average interest rate of 0.05% APY offered by other banks. This makes Quontic Bank a great option for those looking to grow their savings.

2. No Monthly Fees

Another great advantage of Quontic Bank is that it doesn’t charge any monthly fees on its accounts. This is extremely rare among banks, as most charge at least a small monthly fee. This makes Quontic Bank a great option for those who want to avoid paying any fees on their accounts.

3. No Minimum Balance Requirements

Quontic Bank also doesn’t have any minimum balance requirements on its accounts. This means you can open an account with any amount of money and won’t be charged any fees. This is a great benefit for those who don’t have a lot of money to deposit into their accounts.

4. Access to Thousands of ATMs

Quontic Bank customers also have access to thousands of ATMs across the country. This is a great benefit for those who travel frequently or don’t live near a Quontic Bank branch.

5. Excellent Customer Service

Quontic Bank also has an excellent customer service team. This team is available 24/7 to help with any problems you may have. They are also always willing to help with any questions you may have about your account.

6. Generous sign-up bonus

New customers can earn a $100 sign-up bonus when they open a new account and deposit at least $500 within the first 30 days. This is a great way to start your relationship with the bank.

1. Limited Branch Locations

One downside of Quontic Bank is that it has a limited number of branch locations. This can be a problem for those who prefer to do their banking in person. However, the bank does have a large network of ATMs that customers can use.

2. No physical checks:

Quontic Bank does not offer physical checks. This can be inconvenient if you need to write a check for rent or utilities.

3. Minimum deposit requirements:

Quontic Bank has minimum deposit requirements for savings and checking accounts. This can be difficult if you don’t have a lot of money to deposit.

Overall, Quontic Bank is a great option for online banking. The bank offers competitive interest rates, generous sign-up bonuses, and no monthly fees. However, the bank has limited branch locations and customer service hours. Additionally, the bank’s ATM network is limited to the US and there are minimum deposit requirements for savings and checking accounts.

There are a lot of different options when it comes to choosing a bank. There are online banks, traditional banks, and even credit unions. So, which one is the best option for you? Here is a comparison of online banks vs traditional banks to help you make a decision.

There are a few key differences between online banks and traditional banks. One of the biggest differences is the way that they operate.

Online banks are completely digital and don’t have any physical locations. This can be both good and bad. On the one hand, it’s convenient because you can manage your account from anywhere. On the other hand, it can be difficult to get help if you need it.

Traditional banks, on the other hand, have physical locations that you can visit. This can be helpful if you need to talk to someone in person or if you need to deposit cash. However, traditional banks may not have the same level of customer service as online banks.

Another difference between online banks and traditional banks is the fees that they charge. Online banks often have lower fees than traditional banks. This is because they don’t have the same overhead costs. For example, they don’t have to pay for physical locations or tellers.

Finally, online banks and traditional banks offer different types of products and services. Online banks often have more basic products and services. For example, they may not offer investment products or loans. Traditional banks, on the other hand, often have a wider range of products and services.

So, which is better? Online banks or traditional banks? It really depends on your needs. If you need a basic checking or savings account, an online bank may be a good option. If you need more complex products and services, a traditional bank may be a better choice.

In our current day and age, there are many banking options to choose from. This is especially true if you are looking for an online bank. While many reputable and well-known banks have an online presence, not all of them are created equal. When you are looking for a good online bank, there are a few things you should keep in mind.

First and foremost, you want to make sure that the bank you are considering is FDIC-insured. This means that your deposited funds are protected if the bank fails. Unfortunately, not all banks are FDIC-insured, so this is an important factor to consider.

Secondly, you want to take a look at the fees that the bank charges. While all banks charge fees for various services, you want to make sure that the fees are not excessive. Some banks charge high fees just for having an account with them. You should avoid these banks if at all possible.

Third, you want to make sure that the bank offers good customer service. This is important because you want to be able to get help when you need it. Unfortunately, not all banks offer good customer service. If you can’t get help when you need it, then you might as well not have an account with that bank.

Finally, you want to make sure that the bank offers good interest rates. This is important because you want your money to grow over time. Unfortunately, not all banks offer good interest rates. If you can’t get good interest rates, then you should look for another bank.

These are just a few of the things you should keep in mind when you are looking for a good online bank. If you keep these things in mind, you should be able to find a bank that is right for you.

All major banks in the United States are FDIC-insured. However, many online banks are not FDIC-insured. Some of the most popular online banks that are not FDIC-insured include Ally Bank, Discover Bank & CITY Bank. While these banks are not FDIC-insured, they are still reputable and safe places to store your money.

When it comes to choosing an online bank account, there are a few factors to consider. Interest rates, monthly fees, and account features are just a few of the things you’ll need to take into account. We’ve compared a few of the most popular online bank accounts to help you decide which one is right for you.

Ally Bank: Ally offers high-interest rates and has no monthly fees. They also have a great mobile app that makes it easy to bank on the go.

Capital One 360: Capital One 360 also offers high interest rates and has no monthly fees. They have a large network of ATMs, so you can always access your money.

Chase Bank: Chase offers a variety of account options, so you can choose the one that best suits your needs. They also have a large network of ATMs and branches, so you can always access your money.

Each of these online bank accounts has its own set of features and benefits. Weigh your options and choose the account that best suits your needs.

Joint accounts are a type of bank account that allows two or more people to own and manage the account together. Joint accounts can be opened at most traditional banks and credit unions, as well as online banks. Online banks tend to offer more features and benefits than traditional banks, making them a great option for joint account holders. Here are some of the top online banks that offer joint accounts:

1. Ally Bank: Ally offers a wide range of financial products and services, including joint checking and savings accounts. Ally also offers great customer service, online and mobile banking tools, and competitive interest rates.

2. American Express: American Express offers a variety of financial products and services, including joint checking accounts. American Express also offers great customer service, online and mobile banking tools, and a variety of perks and benefits for cardholders.

3. Charles Schwab: Charles Schwab is a full-service brokerage firm that offers a wide range of financial products and services, including joint checking and savings accounts. Schwab also offers great customer service, online and mobile banking tools, and competitive interest rates.

4. Discover: Discover offers a wide range of financial products and services, including joint checking and savings accounts. Discover also offers great customer service, online and mobile banking tools, and a variety of perks and benefits for cardholders.

5. Goldman Sachs: Goldman Sachs is a full-service investment bank that offers a wide range of financial products and services, including joint checking and savings accounts. Goldman Sachs also offers great customer service, online and mobile banking tools, and competitive interest rates.

These are just a few of the many online banks that offer joint accounts. When you’re ready to open a joint account, be sure to compare the features and benefits of each bank to find the best fit for you and your co-owner.

This is a question that many people ask themselves when they are looking for a new bank. There are many advantages and disadvantages to online banking, so it is important to weigh your options before you decide whether or not to switch to an online bank.

Some of the advantages of online banking include the ability to check your account balances and transactions from anywhere with an internet connection, the ability to transfer money between accounts instantly, and the ability to set up automatic bill payments. Online banks also tend to have lower fees than traditional banks, and they often offer higher interest rates on savings accounts.

The disadvantages of online banking include the fact that you can’t deposit cash into your account, you may have to pay fees for some services, and you may not have access to as many branches and ATMs as you would with a traditional bank.

So, is online banking worth it? Ultimately, the decision is up to you. Consider your needs and preferences and make the choice that is best for you.

There are a few online banks that stand standouts when it comes to customer satisfaction, fees, and features. Capital One 360 and Ally Bank are great choices for online banking. Both banks offer free checking and savings accounts with no minimum balance requirements. They also have top-rated mobile apps so you can bank on the go. When it comes to fees, Capital One 360 charges no monthly fees, and Ally Bank only charges a monthly fee if you maintain a balance below $15,000. Lastly, both banks offer features like mobile check deposit and online bill pay.

This is a question that many consumers ask when they are considering using online banking services. The answer is yes, online banks are safe. Online banking is a secure way to manage your finances. Your personal information is protected and you can access your account 24/7.

When you use online banking, you can be confident that your information is safe. Online banks use state-of-the-art security measures to protect your information. Your account is password protected and your information is encrypted. Additionally, online banks often have fraud detection and prevention measures in place.

If you are concerned about the safety of online banking, you can take steps to protect yourself. Be sure to choose a strong password and never share it with anyone. Always log out of your account when you are finished. Be cautious about clicking on links in emails or on websites. Only access your account from a secure, personal computer.

By taking some simple precautions, you can rest assured that your online banking experience will be safe and secure.

There are a few things you’ll need to open a bank account online. First, you’ll need to have a Social Security number or Individual Taxpayer Identification Number. Next, you’ll need to be at least 18 years old and a resident of the United States. You’ll also need to have a valid email address and a phone number. Finally, you’ll need to create a password for your account.

If you have all of the above, then you’re ready to open a bank account online! The process is relatively simple and can be done in just a few minutes. First, you’ll need to choose a bank or credit union that offers online banking. Once you’ve found an institution that meets your needs, you’ll need to visit their website and click on the “Open an Account” button.

From there, you’ll be asked to fill out an application. This will include personal information such as your name, address, and Social Security number. Once you’ve applied, you’ll likely be asked to provide additional documentation to verify your identity. This could include a copy of your driver’s license, passport, or birth certificate.

After you’ve submitted all the necessary information and documentation, you’ll be ready to open your account! The bank or credit union will then issue you an account number and access codes. You’ll use these to log in to your account and begin using online banking services.

There are a few online banks that accept cash deposits, but they are not very common. The most well-known online bank that accepts cash deposits is Capital One 360, but there are others, like Ally Bank and Discover Bank.

The main reason that online banks don’t accept cash deposits is that it is very difficult to track and verify the deposits. Cash is also a lot more prone to fraud than other forms of payment, so online banks are generally very cautious about accepting it.

If you’re looking to deposit cash into an online bank account, your best bet is to find a local branch of the bank and deposit the cash there. You can also usually deposit cash into your account by using an ATM, as long as the ATM is affiliated with the bank.

There are many different online banking apps available, which makes it difficult to determine which one is the best. However, there are a few factors that can help you choose the best app for your needs.

First, consider the features that are important to you. Some apps offer more features than others, so you’ll want to make sure the app you choose has the features you need.

Second, look at the security features of the app. This is important because you’ll want to make sure your personal and financial information is safe.

Third, consider the customer service of the app. This is important because you may need to contact customer service at some point.

Finally, take a look at the reviews of the app. This can be a helpful way to see what other people have to say about the app.

Taking all of these factors into consideration will help you choose the best online banking app for your needs.

There are several types of bank accounts that you can open for free. The most common are savings accounts, checking accounts, and money market accounts. Savings accounts usually have no minimum balance requirements and allow you to withdraw money when you need it. Checking accounts also have no minimum balance requirements, but they may require you to maintain a certain balance to avoid fees. Money market accounts typically have higher minimum balance requirements and may require you to keep your money in the account for a certain period, but they offer higher interest rates than savings or checking accounts.

[…] For those keen on exploring more, I invite you to delve into our comprehensive blog post on ‘The Best Online Banks of the Current Year‘. Here, you’ll find a curated exploration of the top digital banking institutions, each […]